Tokenomics

Reflexive and Dynamic Ecosystem Incentives

Mar 4, 2025

Static token economies have been a long-standing model for crypto projects, using fixed emission schedules and predefined reward structures. However, some projects have been exploring reflexive and dynamic incentive emission algorithms that adjust incentives in real time, based on a variety of metrics and indicators like user behavior and ecosystem health. These dynamic economies promise more sustainable growth, active participation, and enhanced value for token holders.

In this report, we explore how some projects DIMO, Helium, Filecoin, Inverter Network, and Monitize.ai (through VADER’s tokenomics) are implementing dynamic token economies. From real-time reward adjustments to performance-based issuance, these ecosystems are an example of a potential upcoming trend in tokenomics.

DIMO

DIMO is a blockchain-based open and secure mobility platform that is aiming to make cars smarter and more programmable. Through DIMO, drivers and fleets are able to connect their vehicles, access innovative apps and services, and earn rewards. Devs and enterprises can also build mobility products using DIMO’s tools, connectivity, and data

They explain how Bitcoin is an example of a rigid and predictable token economy which fulfills its purpose of it being a digital gold. However, they explain that the DIMO token is not meant to act the same as BTC, and thus, it’s meant to be an asset that powers a dynamic ecosystem that will change throughout time.

DIMO Token Utility

Incentives and Rewards

For generating valuable data

Spend in the marketplace, hardware manufacturers, and ecosystem developers

DIMO Design Principles

Be technically feasible to implement

Be reasonably predictable and sustainable

Be simple and understandable

DIMO Dynamic Vesting Mechanisms

Some of the features are currently live, but many others will be live until later stages.

Baseline rewards are calculated using a points formula. All users earn points based on several variables, and the number of points they earn dictates their share of that week’s issuance.

Baseline Issuance: drivers are rewarded for connecting their cars and streaming data to the network. It ensures consistent engagement even without direct demand for the data.

Marketplace Issuance: Rewards users when their data is consumed by developers and partners through licensed DIMO apps. These transactions are also tied to token burns, enhancing the deflationary economy

Baseline Issuance ends in 40 years, unless modified by a future DIP (DIMO Improvement Proposal)

Tokens are distributed on a weekly basis based on connection type, duration, and hardware:

Hardware Impact: Different devices contribute differently:

Full-Size OBD Dongle (DIMO AutoPi): Higher rewards due to advanced data capabilities.

Mini OBD Dongle (DIMO Macaron): Lower rewards, as the data functionality is more limited by the device.

Points increase over time as users maintain consistent connectivity (through streak bonuses)

The distributions are proportional to the total number of points collected that week and each users’ contributions (for example if 10,000 connected cars generate 60M points and User1 earns 9,000 points, the user will receive 0.015% of the week’s tokens). The distributions are also distributed regardless of if a customer is using the users’ data.

The amount that is distributed each week will start at 1,105,000 $DIMO and will decrease 15% each year.

Users climb rank levels for consistently connecting into the network, and in the same way, can fall back if they don’t connect.

Users have the ability to lock up $DIMO tokens to increase their weekly baseline earnings, similar to the streak bonus.

Hardware manufacturers, node operators, and client publishers have to stake tokens as a security deposit as a condition for receiving a license, but they receive no yield for staking

Additionally, as a mechanism for the platform’s maturity and anticipating demand for vehicle data matures, baseline rewards will taper off, shifting focus to marketplace-based rewards to ensure long-term sustainability.

Helium HIP51 Omni-Protocol PoC Incentives

Helium has adapted their token economy with the aim of scaling the network and supporting the anticipated growth of users, devices, and types of decentralized network protocols. Each subnetwork built atop Helium is called a Decentralized Network Protocols (DNP) which has a subDAO and their own Decentralized Network Tokens (DNTs). Through the Helium HIP-51, they introduce the allocation and management of rewards through subDAOs with flexibility given to each Decentralized Network Protocol (DNP).

HNT Dynamic Vesting Mechanisms

Each DNP operates as its own subDAO with its own governance token (DNT). DNTs have predefined emission schedules but are independently managed by each subDAO. Stakeholders like miners and oracles are rewarded in DNTs, with specific distributions established by subDAO governance

HIP51

On the other hand, veHNT (vote-escrowed HNT, Helium’s native token) acts as the governance mechanism for the broader Helium DAO. Users gain voting power by locking up HNT tokens, with a multiplier based on the lockup duration (e.g., 6 months = 1x, 4 years = 100x). veHNT holders influence subDAO creation, reward distribution models, and network-wide parameters.

Helium’s dynamic vesting model allows subDAOs to adapt their emission schedules and rewards based on their growth stage, ensuring alignment between incentives and network development.

There are additional improvement proposals that make this a 3-part foundation for Helium’s economic model that will maintain their scaling ecosystem

HIP27: proposal that opened a discussion for 5G DNP specific Data Credits mechanisms

The proposal introduced mechanisms to support 5G networks by creating specific reward structures and conversion ratios for Data Credits (DCs)

It established the foundation for a system where rewards are dynamically calculated based on protocol-specific factors like the type of wireless network and geographical location, aligning with HIP-51’s dynamic reward distribution

HIP37: Omni-Protocol PoC

Extended HIP-27 by addressing more technical aspects of Proof-of-Coverage (PoC) for new wireless networks (5G, Wi-Fi)

Proposed splitting PoC rewards based on the proportion of DCs (Data Credits) burned by each protocol, enabling dynamic allocation of rewards across networks in the ecosystem

PoC rules are customized per protocol:

LoRaWAN uses location-based coverage validation

5G involves eSIM-based witnessing and real-time validation of device connections

Rewards for DNPs are dynamically allocated based on a formula that considers:

The amount of veHNT staked within each DNP

Data Credits (DC) burned, as this is an indicator of network usage, because they are consumed whenever data is transmitted across the network, reflecting the level of activity and demand

The number of active devices in the network and associated activation fees

This score determines the share of Helium Network rewards allocated to each subDAO

Note that reward distributions are dynamically recalculated every epoch based on protocol performance, DC burn, device activity, and governance participation

Filecoin Network Baseline

Filecoin justified their hybrid minting model by stating the limitations of exponential decay, showcasing how rewards are highest during a project’s early stages, which can lead to miner over-investment in sealing hardware for rapid storage onboarding.

They saw how this would create incentives mainly for short-term participation, risking data loss and undermining long-term storage requirements.

They propose rewards that are based on timing, not actual storage value provided to the network

FIL Token Dynamic Vesting mechanisms

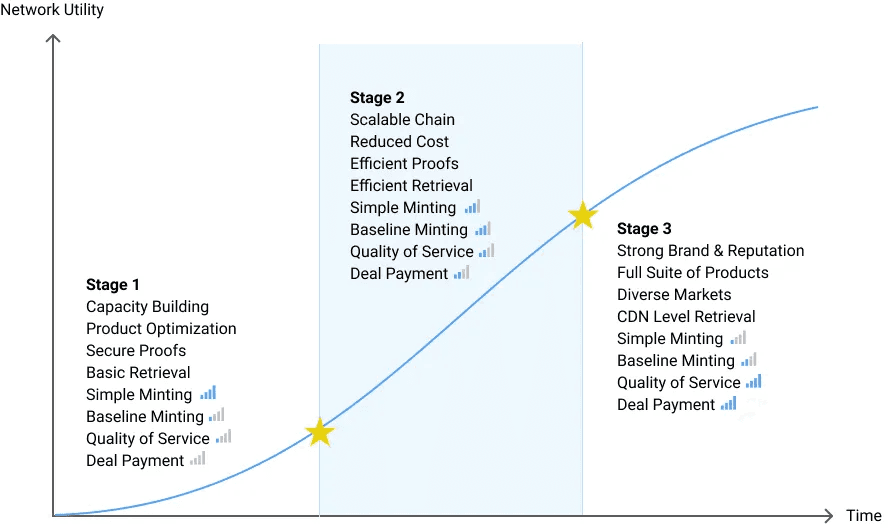

Filecoin’s Network Baseline is a dynamic target that aligns the network’s growth by setting storage capacity goals which double annually. Their mechanism was introduced to influence the distribution of block rewards through a hybrid minting model:

Simple Minting (30%): Distributes rewards at a predetermined rate, independent of network performance.

Through it, early miners were rewarded

Baseline Minting (70%): Adjusts rewards based on the network’s actual storage capacity relative to the baseline target.

Rewards scale with network storage capacity, preserving exponential decay’s trend but being softer on early stages

Rewards are reduced if storage power does not meet the baseline, aligning miner rewards with network utility

The baseline was expected to grow annually by 100%, faster than global storage growth at 40%.

The community can adjust growth rates as the network captures a significant share of global storage.

Filecoin’s Network crossed the Baseline for the first time on April 2nd, 2021.

This meant that the baseline minting was saturated, and the network started to issue block rewards fully to build upon expanding the network

This first stage consisted of building Filecoin during initial phases. When sufficient storage was provided, both providers and clients had engaged with the protocol enough and thus, the economic incentives shifted toward rewarding the most efficient operators

Inverter Network

They manage their token issuance dynamically through its modular “Primary Issuance Market (PIM)” stack. While it isn’t specifically the same as a dynamic vesting mechanism, it can be used as a tool that can be configured to create similar functionalities.

For context, Inverter is a modular token programmability protocol that provides several tools including token deployment without initial liquidity, market-making bots, and token economy configuration and deployment.

Token Economy

The Primary Issuance Market stack is designed to streamline and optimize token issuance and utility management for Web3 projects on Inverter. Projects are enabled to configure and manage their tokens dynamically in order for them to adapt to changing market conditions by enabling them to issue or redeem tokens as needed instead of the traditional model in which the whole supply is minted at once and distributed through vesting schedules. The dynamic vesting can be achieved through several modules including:

Plug and play model with an algorithm library (like drag-and-drop DeFi functionalities)

AI agent library, arbitrage bots, credit scores, and more

PIM Features

Responsive token supply instead of static, enabling on-demand token creation, aligning incentives and supply with demand

Achieve economic resilience through the adjustment of the token supply

Tools to manage the token’s entire lifecycle, from issuance to secondary market activities

The PIM employs algorithm-driven token issuance in which PIM employs custom algorithms that adapt token supply to real-time data, ensuring tokens respond dynamically to market demand and other key performance indicators (KPIs) established by projects. Integrated dynamic pricing algorithms condition token issuance and redemption, creating self-sustaining markets without requiring external liquidity providers.

Monitize.ai

An AI data company

The same team behind VaderResearch, or at least, Vader is part of Monitize

If Monitize’s dynamic vesting is what can be seen in VADER’s tokenomics, then:

Active DAOs managed by either agents or humans are able to charge performance fees, while Passive DAOs, managed solely by VaderAI, will have management fees, with rewards distributed to $VA DER stakers

They have performance-based rewards, fluctuating dynamically based on the success and activity of DAOs, ensuring staking benefits align with the overall health of the ecosystem.

Active DAOs distribute 20% of their performance fee pool to $VADER stakers.

Passive DAOs allocate 0.5% of their management fees to stakers.

(There’s a 100,000 $VADER requirement to launch a DAO)

The staked VADER acts as a gatekeeping mechanism to ensure that only committed participants can launch and manage DAOs

In essence, VADER’s economy creates a feedback loop and adapts to the ecosystem’s activity since rewards are not fixed, but fluctuate based on performance and activity of DAOs. Thanks to this, rewards are tied to the overall health and activity.

Get Expert Help With Your Token Economy

If this article raised questions about your own token design, Simplicity Group's tokenomics consultancy is built to answer them. We work with early-stage and scaling Web3 projects to design token economies that align incentives, sustain liquidity, and survive the long term.