Tokenomics Consultancy for Web3 Projects & Institutions

What Is Tokenomics Consultancy?

Tokenomics consultancy (also called tokenomics consulting) covers the full process of designing, modelling, and stress-testing your token economy before it goes live.

That includes your token supply and distribution, vesting and unlock schedules, staking and reward mechanisms, governance structure, and the long-term incentive design that keeps users engaged rather than selling.

Done well, tokenomics creates a self-reinforcing cycle: value accrues to the token, holders are incentivised to participate, and demand grows alongside the network. Done badly, it creates sell pressure from day one, misaligned stakeholders, and a token price that trends to zero.

Tokenomics consultancy (also called tokenomics consulting) covers the full process of designing, modelling, and stress-testing your token economy before it goes live. That includes your token supply and distribution, vesting and unlock schedules, staking and reward mechanisms, governance structure, and the long-term incentive design that keeps users engaged rather than selling.

Done well, tokenomics creates a self-reinforcing cycle: value accrues to the token, holders are incentivised to participate, and demand grows alongside the network. Done badly, it creates sell pressure from day one, misaligned stakeholders, and a token price that trends to zero.

Our Services

We specialise in tokenomics, and have three main approaches to helping your project.

Audit

Audit your existing token economy.

Starting from $7,500

Audit token utilities ensuring they're based on product.

Audit token utilities ensuring they're

based on product.

Audit economy to confirm the token accrues value & incentives are aligned.

Audit economy to confirm the token accrues value & incentives are aligned.

Verify tokenomics are financially

sound, and in-line with market.

Verify tokenomics are financially sound, and in-line with market.

Verify tokenomics are financially

sound, and in-line with market.

Create a Token Audit document with

the audit results and suggestions to further improve all of the above.

Create a Token Audit document with the audit results and suggestions to further improve all of the above.

Create a Token Audit document with

the audit results and suggestions to

further improve all of the above.

Create a Token Audit document with

the audit results and suggestions to further improve all of the above.

Design

Design a token economy to integrate into your business.

Starting from $15,000

Design token utilities based on

product.

Design token utilities based on product.

Design token utilities based on

product.

Design economy mechanics that

accrue and retain value.

Design economy mechanics that accrue and retain value.

Design economy mechanics that

accrue and retain value.

Design economy mechanics that

accrue and retain value.

Create investable tokenomics based

on fundamentals and market.

Create investable tokenomics based on fundamentals and market.

Create investable tokenomics based

on fundamentals and market.

Provide an investor-ready Token

Paper on the token economy

outlining all of the above.

Provide an investor-ready Token Paper on the token economy outlining all of the above.

Provide an investor-ready Token

Paper on the token economy

outlining all of the above.

Provide an investor-ready Token Paper

on the token economy outlining all of

the above.

Modelling

Model your economy to stress test and set KPIs.

Starting from $15,000

Build model in Machinations to visualise how value flows.

Build model in Machinations to

visualise how value flows.

Model the token price performance, and other key data points.

Model the token price performance, and other key data points.

Model the token price performance,

and other key data points.

Model the token price performance,

and other key data points.

Identify best strategy for token allocations, emissions and launch.

Identify best strategy for token allocations, emissions and launch.

Stress-test the economy and provide data-driven recommendations for mitigating Black Swan events.

Stress-test the economy and provide data-driven recommendations for mitigating Black Swan events.

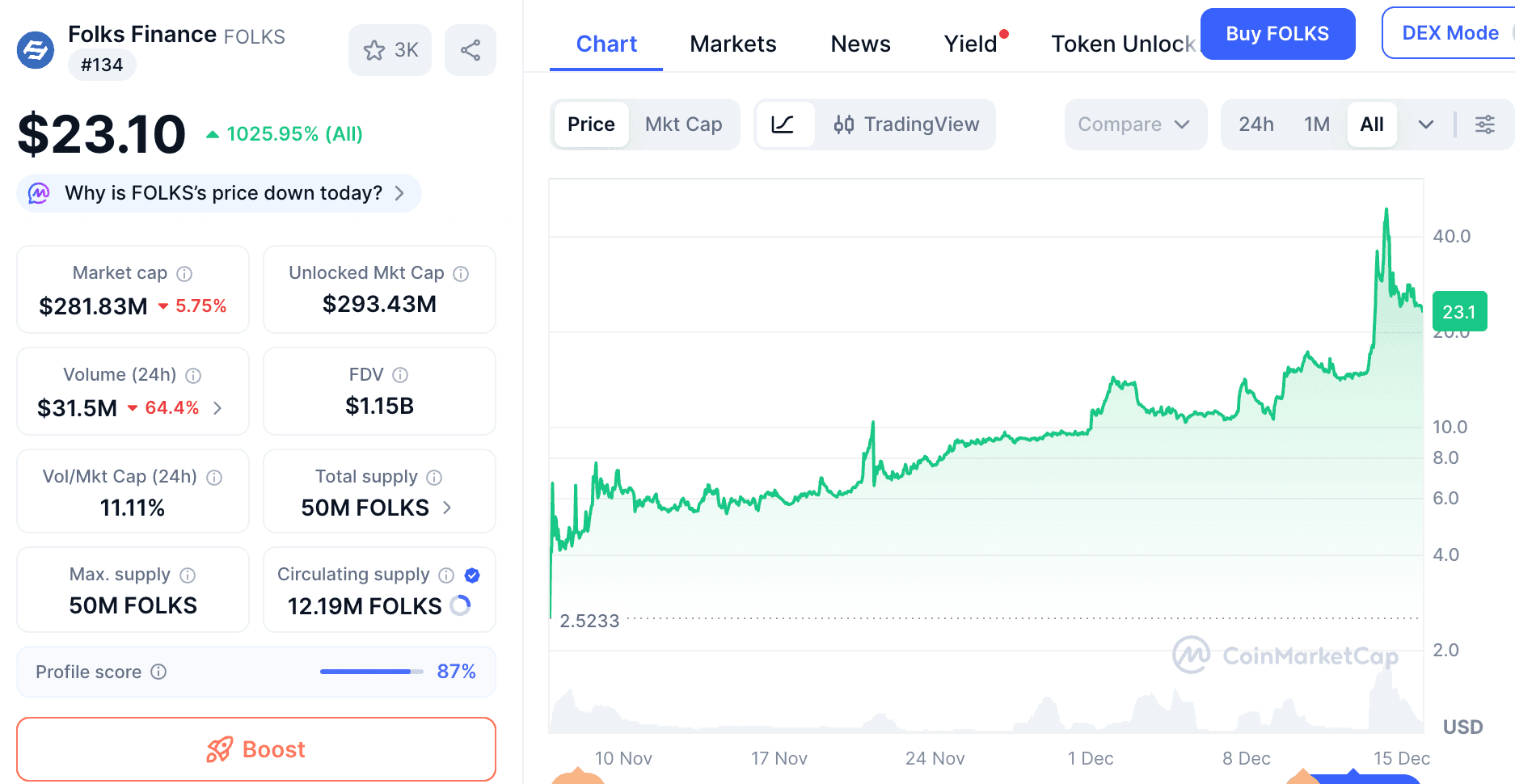

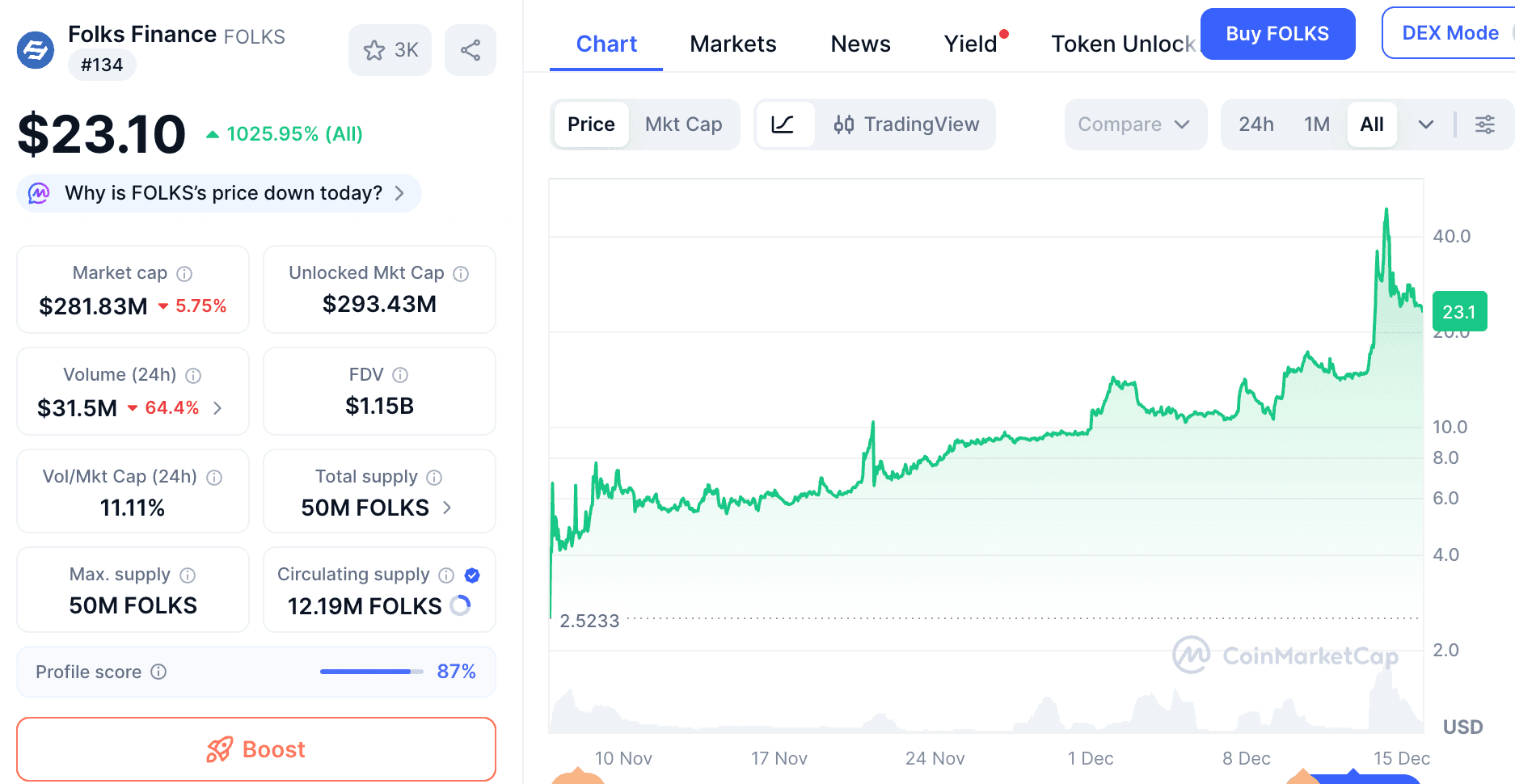

Our clients' launches

Let’s make yours next. We ensure your token launch looks as good as these.

Our clients include

We have worked with various T1 projects across various mandates in the Web3 ecosystem.

Our Process

Stage

Details

Discovery

We start with a deep-dive into your project: the business model, the user types, the growth assumptions, and what the token is actually supposed to do. Many projects skip this step and pay for it later.

Economy Design

We design the full token economy based on what we learn. This covers all the key variables and is documented in a structured specification that your team and investors can review.

Modelling and Stress Testing

We model the economy under a range of scenarios: strong growth, slow growth, bear market conditions, and adversarial behaviour. We test for death spirals, inflationary collapse, and liquidity crises before they happen in the real world.

Iteration

Token economics are rarely right on the first draft. We work through revisions with your team until the model is robust and the design is something you can stand behind.

Final Documentation

Every engagement ends with a full token economy document. This covers the complete design, the modelling outputs, and the rationale behind every decision. You own it outright.

Why tokenomics matters more than most projects think

We have worked with various T1 projects across various mandates in the Web3 ecosystem. By the time a token launches, the economics are essentially fixed. The supply is set. The vesting is in term sheets. The incentive structures are written into smart contracts. Making changes after launch is possible, but it is slow, contentious, and signals instability to the market.

The projects that succeed treat tokenomics as a core product decision, not an afterthought. They model the economy before they design the staking rewards. They think about token velocity before they set emission rates. They understand the difference between a token that captures value and one that simply represents it.

We work at this level. Not just helping you fill in a tokenomics table, but helping you think through the second and third-order effects of every design decision.

Economic design is the blueprint, but execution is the build; discover how we turn theory into a thriving ecosystem through our GTM and advisory services.

What our clients say

We let our clients speak on our behalf.

"I appreciate the work that you guys have done for us! We gained very good insights from the work you've done."

Eric Vander Wal

CEO, Uprising Labs

“The level of knowledge, support, attention to detail as well as speed of delivery and professionalism shown by Simplicity was outstanding. Working with Simplicity is one of the best possible uses of any projects capital.” useful in designing our economy.”

Ian Byrne

CMO, Portal To Bitcoin

"Alex and Daniel brought unparalleled insight into the nuances of tokenomics, offering constant advice around our ideas and strategy. Their proactive communication and commitment were incredibly useful in designing our economy.”

Aki Balogh

CEO, BitSafe

"The Simplicity team helped us auditing our token economy policies to align better with users and token utilities. The modelling was very useful in forecasting key metrics like buy & sell pressure so to plan a healthy and sustainable token model with our incentives.”

Benedetto Biondi

CEO, Folks Finance

"Initially, we started the collaboration with Alex and Daniel just for our tokenomics. Two months later they are our trusted advisors... help with tokenomics, economy, marketing, teach you how the VCs think, and introductions to investors and other web projects that will bring value."

Mihai Nicusor

CEO, World Of Dypians

"The process with the Simplicity team was fascinating, and the results of the audit are going to lead to whole lot changes, and yes, adding major cliffs is 100% one of them! (Together with a max supply, inflation-deflation modifications, additional utilities, and more)."

Matan Doyich

CEO, TeaFi

"Great in depth knowledge while always managing to get the desired outcome. More than just a service. You get top end advice, ideas, and round the clock communications whenever required. Absolute pleasure to work and partner with, highly recommend on behalf of all the team at VESTN"

Craig Jenkinson

CEO, VESTN

Working with Simplicity Group has been an absolute game-changer for us. From the very beginning, their team has been incredibly responsive, offering continuous support and guidance. They have also facilitated key introductions, and helped us build strong partnerships.

Ben

CEO, Octavia

Simplicity are small but mighty - their power lies in their laser-focused approach and outstanding specialised competencies. They’ve been one of our strongest champions this whole time, working with us to shape our product and company from the very beginning.

Brian

Co-Founder, Autonomn

"Simplicity helped us correctly craft our offering to allow positive engagement, whilst also assuring entrance to the right exchanges."

Henry Duckworth

CEO, AgriDex

"I appreciate the work that you guys have done for us! We gained very good insights from the work you've done."

Eric Vander Wal

CEO, Uprising Labs

“The level of knowledge, support, attention to detail as well as speed of delivery and professionalism shown by Simplicity was outstanding. Working with Simplicity is one of the best possible uses of any projects capital.” useful in designing our economy.”

Ian Byrne

CMO, Portal To Bitcoin

"Alex and Daniel brought unparalleled insight into the nuances of tokenomics, offering constant advice around our ideas and strategy. Their proactive communication and commitment were incredibly useful in designing our economy.”

Aki Balogh

CEO, BitSafe

"The Simplicity team helped us auditing our token economy policies to align better with users and token utilities. The modelling was very useful in forecasting key metrics like buy & sell pressure so to plan a healthy and sustainable token model with our incentives.”

Benedetto Biondi

CEO, Folks Finance

"Initially, we started the collaboration with Alex and Daniel just for our tokenomics. Two months later they are our trusted advisors... help with tokenomics, economy, marketing, teach you how the VCs think, and introductions to investors and other web projects that will bring value."

Mihai Nicusor

CEO, World Of Dypians

"The process with the Simplicity team was fascinating, and the results of the audit are going to lead to whole lot changes, and yes, adding major cliffs is 100% one of them! (Together with a max supply, inflation-deflation modifications, additional utilities, and more)."

Matan Doyich

CEO, TeaFi

"Great in depth knowledge while always managing to get the desired outcome. More than just a service. You get top end advice, ideas, and round the clock communications whenever required. Absolute pleasure to work and partner with, highly recommend on behalf of all the team at VESTN"

Craig Jenkinson

CEO, VESTN

Working with Simplicity Group has been an absolute game-changer for us. From the very beginning, their team has been incredibly responsive, offering continuous support and guidance. They have also facilitated key introductions, and helped us build strong partnerships.

Ben

CEO, Octavia

Simplicity are small but mighty - their power lies in their laser-focused approach and outstanding specialised competencies. They’ve been one of our strongest champions this whole time, working with us to shape our product and company from the very beginning.

Brian

Co-Founder, Autonomn

"Simplicity helped us correctly craft our offering to allow positive engagement, whilst also assuring entrance to the right exchanges."

Henry Duckworth

CEO, AgriDex

"I appreciate the work that you guys have done for us! We gained very good insights from the work you've done."

Eric Vander Wal

CEO, Uprising Labs

“The level of knowledge, support, attention to detail as well as speed of delivery and professionalism shown by Simplicity was outstanding. Working with Simplicity is one of the best possible uses of any projects capital.” useful in designing our economy.”

Ian Byrne

CMO, Portal To Bitcoin

"Alex and Daniel brought unparalleled insight into the nuances of tokenomics, offering constant advice around our ideas and strategy. Their proactive communication and commitment were incredibly useful in designing our economy.”

Aki Balogh

CEO, BitSafe

"The Simplicity team helped us auditing our token economy policies to align better with users and token utilities. The modelling was very useful in forecasting key metrics like buy & sell pressure so to plan a healthy and sustainable token model with our incentives.”

Benedetto Biondi

CEO, Folks Finance

"Initially, we started the collaboration with Alex and Daniel just for our tokenomics. Two months later they are our trusted advisors... help with tokenomics, economy, marketing, teach you how the VCs think, and introductions to investors and other web projects that will bring value."

Mihai Nicusor

CEO, World Of Dypians

"The process with the Simplicity team was fascinating, and the results of the audit are going to lead to whole lot changes, and yes, adding major cliffs is 100% one of them! (Together with a max supply, inflation-deflation modifications, additional utilities, and more)."

Matan Doyich

CEO, TeaFi

"Great in depth knowledge while always managing to get the desired outcome. More than just a service. You get top end advice, ideas, and round the clock communications whenever required. Absolute pleasure to work and partner with, highly recommend on behalf of all the team at VESTN"

Craig Jenkinson

CEO, VESTN

Working with Simplicity Group has been an absolute game-changer for us. From the very beginning, their team has been incredibly responsive, offering continuous support and guidance. They have also facilitated key introductions, and helped us build strong partnerships.

Ben

CEO, Octavia

Simplicity are small but mighty - their power lies in their laser-focused approach and outstanding specialised competencies. They’ve been one of our strongest champions this whole time, working with us to shape our product and company from the very beginning.

Brian

Co-Founder, Autonomn

"Simplicity helped us correctly craft our offering to allow positive engagement, whilst also assuring entrance to the right exchanges."

Henry Duckworth

CEO, AgriDex

"I appreciate the work that you guys have done for us! We gained very good insights from the work you've done."

Eric Vander Wal

CEO, Uprising Labs

“The level of knowledge, support, attention to detail as well as speed of delivery and professionalism shown by Simplicity was outstanding. Working with Simplicity is one of the best possible uses of any projects capital.” useful in designing our economy.”

Ian Byrne

CMO, Portal To Bitcoin

"Alex and Daniel brought unparalleled insight into the nuances of tokenomics, offering constant advice around our ideas and strategy. Their proactive communication and commitment were incredibly useful in designing our economy.”

Aki Balogh

CEO, BitSafe

"The Simplicity team helped us auditing our token economy policies to align better with users and token utilities. The modelling was very useful in forecasting key metrics like buy & sell pressure so to plan a healthy and sustainable token model with our incentives.”

Benedetto Biondi

CEO, Folks Finance

"Initially, we started the collaboration with Alex and Daniel just for our tokenomics. Two months later they are our trusted advisors... help with tokenomics, economy, marketing, teach you how the VCs think, and introductions to investors and other web projects that will bring value."

Mihai Nicusor

CEO, World Of Dypians

"The process with the Simplicity team was fascinating, and the results of the audit are going to lead to whole lot changes, and yes, adding major cliffs is 100% one of them! (Together with a max supply, inflation-deflation modifications, additional utilities, and more)."

Matan Doyich

CEO, TeaFi

"Great in depth knowledge while always managing to get the desired outcome. More than just a service. You get top end advice, ideas, and round the clock communications whenever required. Absolute pleasure to work and partner with, highly recommend on behalf of all the team at VESTN"

Craig Jenkinson

CEO, VESTN

Working with Simplicity Group has been an absolute game-changer for us. From the very beginning, their team has been incredibly responsive, offering continuous support and guidance. They have also facilitated key introductions, and helped us build strong partnerships.

Ben

CEO, Octavia

Simplicity are small but mighty - their power lies in their laser-focused approach and outstanding specialised competencies. They’ve been one of our strongest champions this whole time, working with us to shape our product and company from the very beginning.

Brian

Co-Founder, Autonomn

"Simplicity helped us correctly craft our offering to allow positive engagement, whilst also assuring entrance to the right exchanges."

Henry Duckworth

CEO, AgriDex

"I appreciate the work that you guys have done for us! We gained very good insights from the work you've done."

Eric Vander Wal

CEO, Uprising Labs

“The level of knowledge, support, attention to detail as well as speed of delivery and professionalism shown by Simplicity was outstanding. Working with Simplicity is one of the best possible uses of any projects capital.” useful in designing our economy.”

Ian Byrne

CMO, Portal To Bitcoin

"Alex and Daniel brought unparalleled insight into the nuances of tokenomics, offering constant advice around our ideas and strategy. Their proactive communication and commitment were incredibly useful in designing our economy.”

Aki Balogh

CEO, BitSafe

"The Simplicity team helped us auditing our token economy policies to align better with users and token utilities. The modelling was very useful in forecasting key metrics like buy & sell pressure so to plan a healthy and sustainable token model with our incentives.”

Benedetto Biondi

CEO, Folks Finance

"Initially, we started the collaboration with Alex and Daniel just for our tokenomics. Two months later they are our trusted advisors... help with tokenomics, economy, marketing, teach you how the VCs think, and introductions to investors and other web projects that will bring value."

Mihai Nicusor

CEO, World Of Dypians

"The process with the Simplicity team was fascinating, and the results of the audit are going to lead to whole lot changes, and yes, adding major cliffs is 100% one of them! (Together with a max supply, inflation-deflation modifications, additional utilities, and more)."

Matan Doyich

CEO, TeaFi

"Great in depth knowledge while always managing to get the desired outcome. More than just a service. You get top end advice, ideas, and round the clock communications whenever required. Absolute pleasure to work and partner with, highly recommend on behalf of all the team at VESTN"

Craig Jenkinson

CEO, VESTN

Working with Simplicity Group has been an absolute game-changer for us. From the very beginning, their team has been incredibly responsive, offering continuous support and guidance. They have also facilitated key introductions, and helped us build strong partnerships.

Ben

CEO, Octavia

Simplicity are small but mighty - their power lies in their laser-focused approach and outstanding specialised competencies. They’ve been one of our strongest champions this whole time, working with us to shape our product and company from the very beginning.

Brian

Co-Founder, Autonomn

"Simplicity helped us correctly craft our offering to allow positive engagement, whilst also assuring entrance to the right exchanges."

Henry Duckworth

CEO, AgriDex

"I appreciate the work that you guys have done for us! We gained very good insights from the work you've done."

Eric Vander Wal

CEO, Uprising Labs

“The level of knowledge, support, attention to detail as well as speed of delivery and professionalism shown by Simplicity was outstanding. Working with Simplicity is one of the best possible uses of any projects capital.” useful in designing our economy.”

Ian Byrne

CMO, Portal To Bitcoin

"Alex and Daniel brought unparalleled insight into the nuances of tokenomics, offering constant advice around our ideas and strategy. Their proactive communication and commitment were incredibly useful in designing our economy.”

Aki Balogh

CEO, BitSafe

"The Simplicity team helped us auditing our token economy policies to align better with users and token utilities. The modelling was very useful in forecasting key metrics like buy & sell pressure so to plan a healthy and sustainable token model with our incentives.”

Benedetto Biondi

CEO, Folks Finance

"Initially, we started the collaboration with Alex and Daniel just for our tokenomics. Two months later they are our trusted advisors... help with tokenomics, economy, marketing, teach you how the VCs think, and introductions to investors and other web projects that will bring value."

Mihai Nicusor

CEO, World Of Dypians

"The process with the Simplicity team was fascinating, and the results of the audit are going to lead to whole lot changes, and yes, adding major cliffs is 100% one of them! (Together with a max supply, inflation-deflation modifications, additional utilities, and more)."

Matan Doyich

CEO, TeaFi

"Great in depth knowledge while always managing to get the desired outcome. More than just a service. You get top end advice, ideas, and round the clock communications whenever required. Absolute pleasure to work and partner with, highly recommend on behalf of all the team at VESTN"

Craig Jenkinson

CEO, VESTN

Working with Simplicity Group has been an absolute game-changer for us. From the very beginning, their team has been incredibly responsive, offering continuous support and guidance. They have also facilitated key introductions, and helped us build strong partnerships.

Ben

CEO, Octavia

Simplicity are small but mighty - their power lies in their laser-focused approach and outstanding specialised competencies. They’ve been one of our strongest champions this whole time, working with us to shape our product and company from the very beginning.

Brian

Co-Founder, Autonomn

"Simplicity helped us correctly craft our offering to allow positive engagement, whilst also assuring entrance to the right exchanges."

Henry Duckworth

CEO, AgriDex

"I appreciate the work that you guys have done for us! We gained very good insights from the work you've done."

Eric Vander Wal

CEO, Uprising Labs

“The level of knowledge, support, attention to detail as well as speed of delivery and professionalism shown by Simplicity was outstanding. Working with Simplicity is one of the best possible uses of any projects capital.” useful in designing our economy.”

Ian Byrne

CMO, Portal To Bitcoin

"Alex and Daniel brought unparalleled insight into the nuances of tokenomics, offering constant advice around our ideas and strategy. Their proactive communication and commitment were incredibly useful in designing our economy.”

Aki Balogh

CEO, BitSafe

"The Simplicity team helped us auditing our token economy policies to align better with users and token utilities. The modelling was very useful in forecasting key metrics like buy & sell pressure so to plan a healthy and sustainable token model with our incentives.”

Benedetto Biondi

CEO, Folks Finance

"Initially, we started the collaboration with Alex and Daniel just for our tokenomics. Two months later they are our trusted advisors... help with tokenomics, economy, marketing, teach you how the VCs think, and introductions to investors and other web projects that will bring value."

Mihai Nicusor

CEO, World Of Dypians

"The process with the Simplicity team was fascinating, and the results of the audit are going to lead to whole lot changes, and yes, adding major cliffs is 100% one of them! (Together with a max supply, inflation-deflation modifications, additional utilities, and more)."

Matan Doyich

CEO, TeaFi

"Great in depth knowledge while always managing to get the desired outcome. More than just a service. You get top end advice, ideas, and round the clock communications whenever required. Absolute pleasure to work and partner with, highly recommend on behalf of all the team at VESTN"

Craig Jenkinson

CEO, VESTN

Working with Simplicity Group has been an absolute game-changer for us. From the very beginning, their team has been incredibly responsive, offering continuous support and guidance. They have also facilitated key introductions, and helped us build strong partnerships.

Ben

CEO, Octavia

Simplicity are small but mighty - their power lies in their laser-focused approach and outstanding specialised competencies. They’ve been one of our strongest champions this whole time, working with us to shape our product and company from the very beginning.

Brian

Co-Founder, Autonomn

"Simplicity helped us correctly craft our offering to allow positive engagement, whilst also assuring entrance to the right exchanges."

Henry Duckworth

CEO, AgriDex

"I appreciate the work that you guys have done for us! We gained very good insights from the work you've done."

Eric Vander Wal

CEO, Uprising Labs

“The level of knowledge, support, attention to detail as well as speed of delivery and professionalism shown by Simplicity was outstanding. Working with Simplicity is one of the best possible uses of any projects capital.” useful in designing our economy.”

Ian Byrne

CMO, Portal To Bitcoin

"Alex and Daniel brought unparalleled insight into the nuances of tokenomics, offering constant advice around our ideas and strategy. Their proactive communication and commitment were incredibly useful in designing our economy.”

Aki Balogh

CEO, BitSafe

"The Simplicity team helped us auditing our token economy policies to align better with users and token utilities. The modelling was very useful in forecasting key metrics like buy & sell pressure so to plan a healthy and sustainable token model with our incentives.”

Benedetto Biondi

CEO, Folks Finance

"Initially, we started the collaboration with Alex and Daniel just for our tokenomics. Two months later they are our trusted advisors... help with tokenomics, economy, marketing, teach you how the VCs think, and introductions to investors and other web projects that will bring value."

Mihai Nicusor

CEO, World Of Dypians

"The process with the Simplicity team was fascinating, and the results of the audit are going to lead to whole lot changes, and yes, adding major cliffs is 100% one of them! (Together with a max supply, inflation-deflation modifications, additional utilities, and more)."

Matan Doyich

CEO, TeaFi

"Great in depth knowledge while always managing to get the desired outcome. More than just a service. You get top end advice, ideas, and round the clock communications whenever required. Absolute pleasure to work and partner with, highly recommend on behalf of all the team at VESTN"

Craig Jenkinson

CEO, VESTN

Working with Simplicity Group has been an absolute game-changer for us. From the very beginning, their team has been incredibly responsive, offering continuous support and guidance. They have also facilitated key introductions, and helped us build strong partnerships.

Ben

CEO, Octavia

Simplicity are small but mighty - their power lies in their laser-focused approach and outstanding specialised competencies. They’ve been one of our strongest champions this whole time, working with us to shape our product and company from the very beginning.

Brian

Co-Founder, Autonomn

"Simplicity helped us correctly craft our offering to allow positive engagement, whilst also assuring entrance to the right exchanges."

Henry Duckworth

CEO, AgriDex

"I appreciate the work that you guys have done for us! We gained very good insights from the work you've done."

Eric Vander Wal

CEO, Uprising Labs

“The level of knowledge, support, attention to detail as well as speed of delivery and professionalism shown by Simplicity was outstanding. Working with Simplicity is one of the best possible uses of any projects capital.” useful in designing our economy.”

Ian Byrne

CMO, Portal To Bitcoin

"Alex and Daniel brought unparalleled insight into the nuances of tokenomics, offering constant advice around our ideas and strategy. Their proactive communication and commitment were incredibly useful in designing our economy.”

Aki Balogh

CEO, BitSafe

"The Simplicity team helped us auditing our token economy policies to align better with users and token utilities. The modelling was very useful in forecasting key metrics like buy & sell pressure so to plan a healthy and sustainable token model with our incentives.”

Benedetto Biondi

CEO, Folks Finance

"Initially, we started the collaboration with Alex and Daniel just for our tokenomics. Two months later they are our trusted advisors... help with tokenomics, economy, marketing, teach you how the VCs think, and introductions to investors and other web projects that will bring value."

Mihai Nicusor

CEO, World Of Dypians

"The process with the Simplicity team was fascinating, and the results of the audit are going to lead to whole lot changes, and yes, adding major cliffs is 100% one of them! (Together with a max supply, inflation-deflation modifications, additional utilities, and more)."

Matan Doyich

CEO, TeaFi

"Great in depth knowledge while always managing to get the desired outcome. More than just a service. You get top end advice, ideas, and round the clock communications whenever required. Absolute pleasure to work and partner with, highly recommend on behalf of all the team at VESTN"

Craig Jenkinson

CEO, VESTN

Working with Simplicity Group has been an absolute game-changer for us. From the very beginning, their team has been incredibly responsive, offering continuous support and guidance. They have also facilitated key introductions, and helped us build strong partnerships.

Ben

CEO, Octavia

Simplicity are small but mighty - their power lies in their laser-focused approach and outstanding specialised competencies. They’ve been one of our strongest champions this whole time, working with us to shape our product and company from the very beginning.

Brian

Co-Founder, Autonomn

"Simplicity helped us correctly craft our offering to allow positive engagement, whilst also assuring entrance to the right exchanges."

Henry Duckworth

CEO, AgriDex

"I appreciate the work that you guys have done for us! We gained very good insights from the work you've done."

Eric Vander Wal

CEO, Uprising Labs

“The level of knowledge, support, attention to detail as well as speed of delivery and professionalism shown by Simplicity was outstanding. Working with Simplicity is one of the best possible uses of any projects capital.” useful in designing our economy.”

Ian Byrne

CMO, Portal To Bitcoin

"Alex and Daniel brought unparalleled insight into the nuances of tokenomics, offering constant advice around our ideas and strategy. Their proactive communication and commitment were incredibly useful in designing our economy.”

Aki Balogh

CEO, BitSafe

"The Simplicity team helped us auditing our token economy policies to align better with users and token utilities. The modelling was very useful in forecasting key metrics like buy & sell pressure so to plan a healthy and sustainable token model with our incentives.”

Benedetto Biondi

CEO, Folks Finance

"Initially, we started the collaboration with Alex and Daniel just for our tokenomics. Two months later they are our trusted advisors... help with tokenomics, economy, marketing, teach you how the VCs think, and introductions to investors and other web projects that will bring value."

Mihai Nicusor

CEO, World Of Dypians

"The process with the Simplicity team was fascinating, and the results of the audit are going to lead to whole lot changes, and yes, adding major cliffs is 100% one of them! (Together with a max supply, inflation-deflation modifications, additional utilities, and more)."

Matan Doyich

CEO, TeaFi

"Great in depth knowledge while always managing to get the desired outcome. More than just a service. You get top end advice, ideas, and round the clock communications whenever required. Absolute pleasure to work and partner with, highly recommend on behalf of all the team at VESTN"

Craig Jenkinson

CEO, VESTN

Working with Simplicity Group has been an absolute game-changer for us. From the very beginning, their team has been incredibly responsive, offering continuous support and guidance. They have also facilitated key introductions, and helped us build strong partnerships.

Ben

CEO, Octavia

Simplicity are small but mighty - their power lies in their laser-focused approach and outstanding specialised competencies. They’ve been one of our strongest champions this whole time, working with us to shape our product and company from the very beginning.

Brian

Co-Founder, Autonomn

"Simplicity helped us correctly craft our offering to allow positive engagement, whilst also assuring entrance to the right exchanges."

Henry Duckworth

CEO, AgriDex

"I appreciate the work that you guys have done for us! We gained very good insights from the work you've done."

Eric Vander Wal

CEO, Uprising Labs

“The level of knowledge, support, attention to detail as well as speed of delivery and professionalism shown by Simplicity was outstanding. Working with Simplicity is one of the best possible uses of any projects capital.” useful in designing our economy.”

Ian Byrne

CMO, Portal To Bitcoin

"Alex and Daniel brought unparalleled insight into the nuances of tokenomics, offering constant advice around our ideas and strategy. Their proactive communication and commitment were incredibly useful in designing our economy.”

Aki Balogh

CEO, BitSafe

"The Simplicity team helped us auditing our token economy policies to align better with users and token utilities. The modelling was very useful in forecasting key metrics like buy & sell pressure so to plan a healthy and sustainable token model with our incentives.”

Benedetto Biondi

CEO, Folks Finance

"Initially, we started the collaboration with Alex and Daniel just for our tokenomics. Two months later they are our trusted advisors... help with tokenomics, economy, marketing, teach you how the VCs think, and introductions to investors and other web projects that will bring value."

Mihai Nicusor

CEO, World Of Dypians

"The process with the Simplicity team was fascinating, and the results of the audit are going to lead to whole lot changes, and yes, adding major cliffs is 100% one of them! (Together with a max supply, inflation-deflation modifications, additional utilities, and more)."

Matan Doyich

CEO, TeaFi

"Great in depth knowledge while always managing to get the desired outcome. More than just a service. You get top end advice, ideas, and round the clock communications whenever required. Absolute pleasure to work and partner with, highly recommend on behalf of all the team at VESTN"

Craig Jenkinson

CEO, VESTN

Working with Simplicity Group has been an absolute game-changer for us. From the very beginning, their team has been incredibly responsive, offering continuous support and guidance. They have also facilitated key introductions, and helped us build strong partnerships.

Ben

CEO, Octavia

Simplicity are small but mighty - their power lies in their laser-focused approach and outstanding specialised competencies. They’ve been one of our strongest champions this whole time, working with us to shape our product and company from the very beginning.

Brian

Co-Founder, Autonomn

"Simplicity helped us correctly craft our offering to allow positive engagement, whilst also assuring entrance to the right exchanges."

Henry Duckworth

CEO, AgriDex

"I appreciate the work that you guys have done for us! We gained very good insights from the work you've done."

Eric Vander Wal

CEO, Uprising Labs

“The level of knowledge, support, attention to detail as well as speed of delivery and professionalism shown by Simplicity was outstanding. Working with Simplicity is one of the best possible uses of any projects capital.” useful in designing our economy.”

Ian Byrne

CMO, Portal To Bitcoin

"Alex and Daniel brought unparalleled insight into the nuances of tokenomics, offering constant advice around our ideas and strategy. Their proactive communication and commitment were incredibly useful in designing our economy.”

Aki Balogh

CEO, BitSafe

"The Simplicity team helped us auditing our token economy policies to align better with users and token utilities. The modelling was very useful in forecasting key metrics like buy & sell pressure so to plan a healthy and sustainable token model with our incentives.”

Benedetto Biondi

CEO, Folks Finance

"Initially, we started the collaboration with Alex and Daniel just for our tokenomics. Two months later they are our trusted advisors... help with tokenomics, economy, marketing, teach you how the VCs think, and introductions to investors and other web projects that will bring value."

Mihai Nicusor

CEO, World Of Dypians

"The process with the Simplicity team was fascinating, and the results of the audit are going to lead to whole lot changes, and yes, adding major cliffs is 100% one of them! (Together with a max supply, inflation-deflation modifications, additional utilities, and more)."

Matan Doyich

CEO, TeaFi

"Great in depth knowledge while always managing to get the desired outcome. More than just a service. You get top end advice, ideas, and round the clock communications whenever required. Absolute pleasure to work and partner with, highly recommend on behalf of all the team at VESTN"

Craig Jenkinson

CEO, VESTN

Working with Simplicity Group has been an absolute game-changer for us. From the very beginning, their team has been incredibly responsive, offering continuous support and guidance. They have also facilitated key introductions, and helped us build strong partnerships.

Ben

CEO, Octavia

Simplicity are small but mighty - their power lies in their laser-focused approach and outstanding specialised competencies. They’ve been one of our strongest champions this whole time, working with us to shape our product and company from the very beginning.

Brian

Co-Founder, Autonomn

"Simplicity helped us correctly craft our offering to allow positive engagement, whilst also assuring entrance to the right exchanges."

Henry Duckworth

CEO, AgriDex

Frequently asked questions

Here are the top questions our clients ask before getting started.

What deliverables do I receive after using your Tokenomics Consultancy services?

The deliverables depend on the engagement, but you will always receive a final document with your full token economy and strategy outlined.

How do you determine the ideal token supply and vesting schedule?

Token supply is irrelevant. What matters is the valuation, with regards to vesting, projected financials, and user growth of your business.

Does my project need a dual-token or single-token system?

There is no one answer fits all, however, generally speaking dual-token economies make sense when there is need for a soft and hard currency.

Do you work for fiat/stablecoins or equity/tokens?

We work for a mix of fiat/stablecoins and equity/tokens. The fiat keeps the lights on, and the equity/tokens provide long term upside.

Do you offer post-TGE (Token Generation Event) monitoring and advisory?

Yes, we can work with clients after TGE. This typically includes adjusting token emissions, and modelling the economy to explore potential changes for a V2 economy.

How do you prevent "Death Spirals" in token economic design?

We prevent death spirals by anchoring the token to tangible utility and dynamically aligning emission rates with actual network growth, ensuring that value creation always outpaces token inflation.

Do you use Machinations.io or Python for token modeling and stress testing?

We generally use Machinations when modelling and stress testing economies, and would only recommend Python to well financed business' with extremely complex economy.

Ready to Build a Sustainable Token Economy?

If your project is approaching TGE or still in the design phase, now is the time to get the economics right.

Ready to work together?

Book a free consultation to speak with our team and discuss your goals. Let’s build a smarter, better future for your business.

Ready to Build a Sustainable Token Economy?

If your project is approaching TGE or still in the design phase, now is the time to get the economics right.