Discussions

Does crypto value Fundamentals?

May 4, 2024

Speculation vs Usage

Introduction

Throughout the entirety of the crypto market, we can see some high valuations amidst protocols that are arguably completely unutilized. The question that arises is what actually drives the largest sum of value in these markets: the actual usage of these protocols and projects, or the speculative aspect of the crypto markets? In this article, we will use numerous crypto narratives (and Cardano) as examples and case studies to procure a valid and unbiased conclusion on the primary drivers of value creation in the cryptocurrency market.

Firstly, let’s define the terms used. Usage (U) refers to the broad idea of actual users using protocols’ and projects’ tokens, thereby increasing the project’s value. In contrast, speculation (S) refers to the speculative investment strategy evident in both traditional stock investing and the cryptocurrency market. Speculative value is derived from either short-term trading or investor hypotheses which expect the protocols or companies to see future success and adoption in U, and thus real value.

A prime example of U vs S in Web2 would be a comparison between Apple and GameStop. Admittedly, no one uses Apple stock for anything; in fact, no retail investor uses any stocks for utility purposes except dividends payouts, unlike cryptocurrency. Thus, in this example, U will refer to the intrinsic real value derived from purchases of company inventions and service provisions. Apple, the second most valuable stock in the world by market cap, has reached its valuation primarily through the actual products and services it delivers to end-users. In contrast, GameStop (GME) derives its value almost solely from stock speculators and meme-stock enthusiasts. All of GameStop’s fundamentals are poor, and its actual business is bad at best, but its value increases immensely (admittedly sporadically). This should clarify the distinction between U and S clearly within the Web2 ecosphere, which should be easy to understand and translate into how this same dichotomy takes place in Web3.

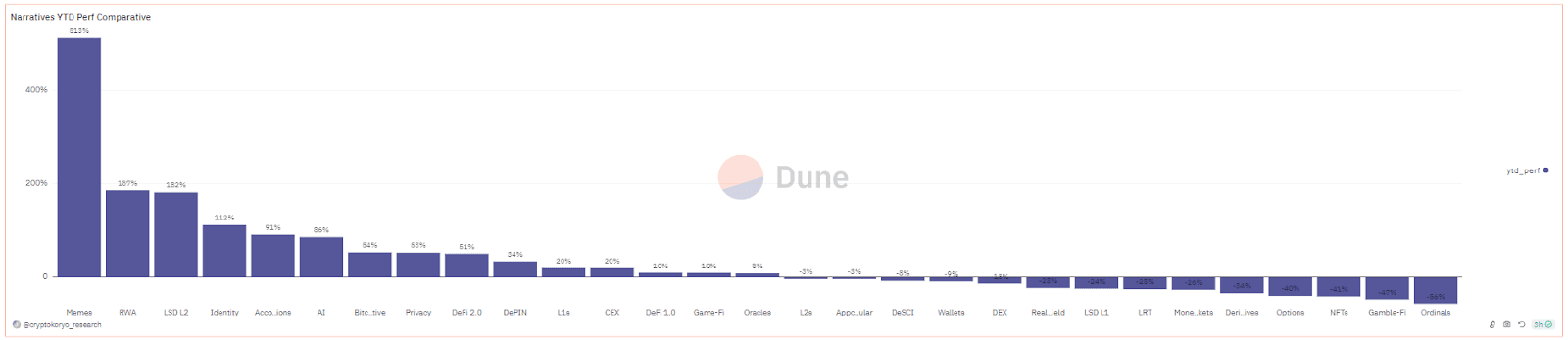

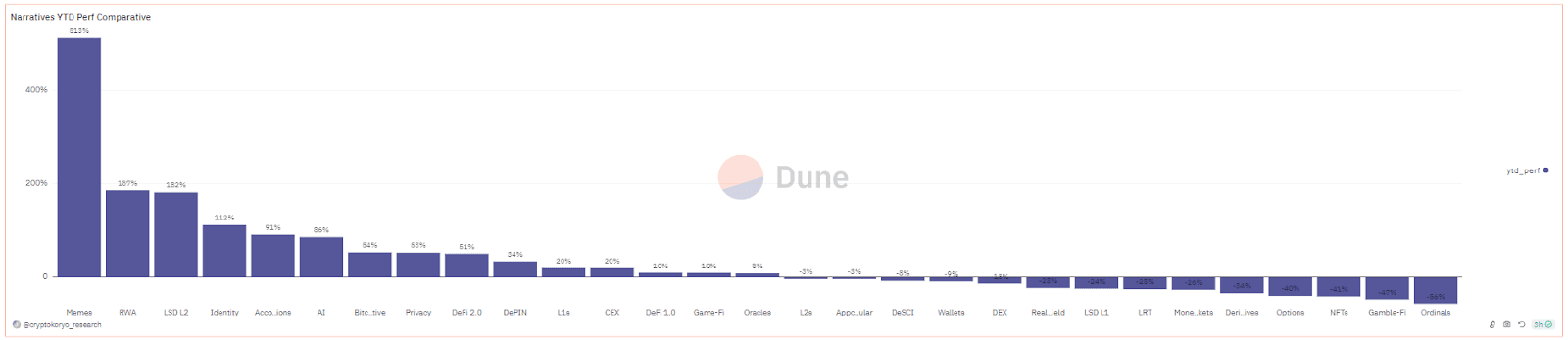

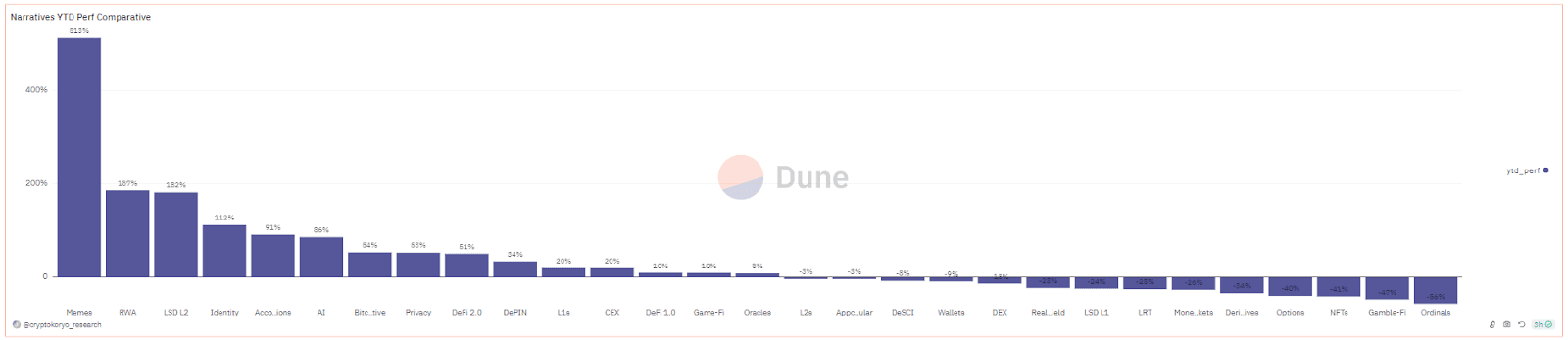

In terms of Web3 U vs. S, we see an extreme disbalance as well. Numerous narratives like RWA and AI are prime examples of speculative narratives. These crypto narratives have increased in value by billions of dollars YTD, meanwhile, the actual usage of these protocols is extremely low. Let’s do a deep dive into the value accrual and Usage vs. Speculation in these narratives and protocol case studies.

Note: whilst we understand that token price is also the result of many more factors, such as tokenomics, market making, macro conditions, and so on, we alienate the notions of intrinsic value and speculation for clarity and simplicity.

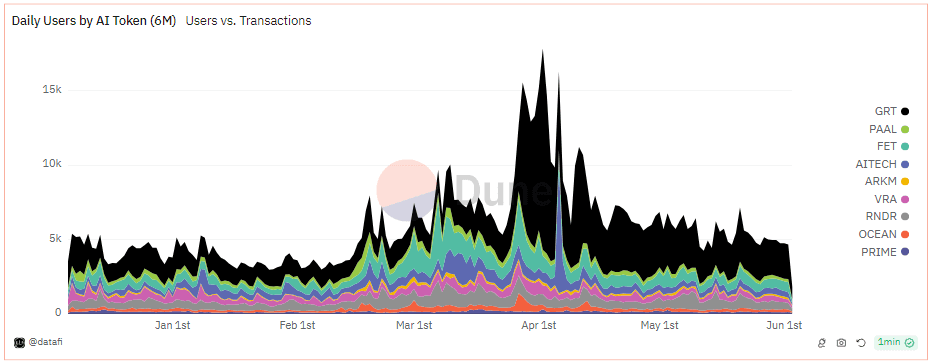

AI

The AI crypto narrative is a class-A example of U vs S. The actual userbase of AI protocols is extremely low (see 1) but it has consistently outperformed Bitcoin and the rest of altcoins over the past year (see 2). This begs the question, why? What is driving this performance of the AI narrative if not the actual U?

Clearly, the largest driver of value in the AI narrative is speculation. The majority of purchases of AI tokens consistently occur shortly after positive news is released concerning Web2 AI adoption. These news releases range from new ChatGPT models to extensively successful revenue reports from AI and computer-chip giant NVIDIA.

Similarly, we saw an immense increase in value for three crypto AI leaders, namely, Fetch.AI (FET), SingularityNET (AGIX), and Ocean Protocol (OCEAN) when they announced the three protocols will perform a merger into one token: Artificial Superintelligence Alliance (ASI). This rally can also clearly be attributed to S rather than U since there was no increase in userbase or palpable difference in the tokens’ respective values. Rather, the rise in prices can be attributed to speculation concerning the value this merger may or may not create in the future (the merger is set to finalize on the 13th of June 2024 (see here)).

1. Source: @datafi on Dune

2. Source: @cryptokoryo_research on Dune

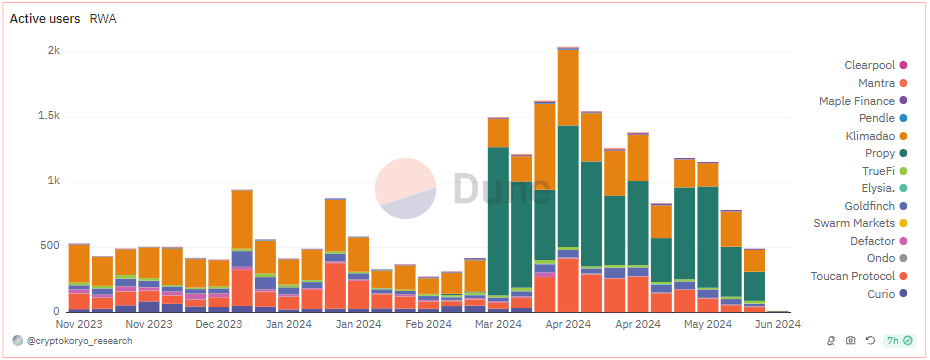

RWA

The Real-World-Asset (RWA) narrative is another class-A example of U vs. S. Similar to the entirety of the crypto AI narrative the RWA narrative has an extremely low sum of active users (see 3), despite this, it is the second best-performing narrative YTD (see 4).

The primary drivers of RWA value are once more external factors rather than internal usage-based value accrual. The most common speculative story spun in the RWA narrative is the extensive interest BlackRock’s CEO Larry Finch has publicly disclosed in numerous interviews. Larry Funk publicly stated, that “[these] ETFs are stepping stones towards tokenization, and I believe that’s where we’re headed,” (see here). The interest BlackRock, the largest asset manager in the world, has shown in the tokenization industry has resulted in significant rallies and speculation in the RWA market.

Despite the interest of firms like BlackRock, few RWA protocols have driven a sizeable user base to their protocols. For example, Ondo has put in a rally of over 500% YTD, although the active userbase is so miniature it can’t even be seen in the RWA Active Users bar chart shown below. Ultimately, once more we see the majority of the value accrual in an entire narrative being led by speculation rather than real usage.

3. Source: @cryptokoryo_research on Dune

4. Source: @cryptokoryo_research on Dune

Memes

Memes, as a crypto narrative, stand at the pinnacle of speculative asset classes. The vast majority of memes provide zero actual use cases or advantages except for being an easily accessible, tradeable, and risky asset class. There is no real deep-dive necessary here, the data below should provide sufficient insight into the immense outperformance memes have had relative to the rest of the crypto industry despite them providing no infrastructure or use case.

5. Source: @cryptokoryo_research on Dune

GameFi

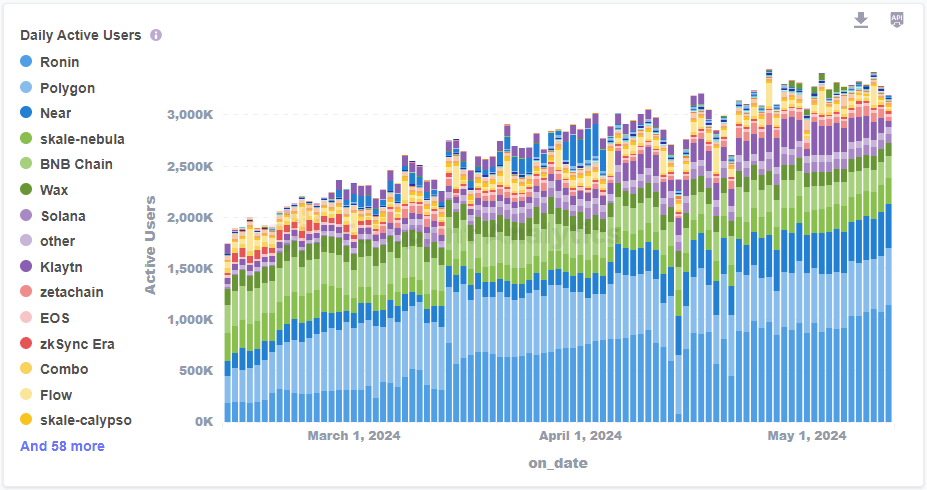

In our recent article on The State of GameFi in 2024, we dove deep into GameFi adoption data and found it to be one of the more adopted industries in terms of real usage despite it being one of the worst-performing narratives YTD in terms of price increases.

In terms of U, we see relatively high adoption in this industry. For example, 40% of BNB’s daily active users (DAUs) engage with gaming dApps. Major gaming institutions like Ubisoft and SuperCell have entered the space, collaborating with blockchain platforms and potentially attracting other established gaming studios. This could lead to higher-quality games and a more immersive gaming experience. Additionally, daily active users of Web3 games are steadily growing, with the Ronin chain experiencing significant growth (see 6). As of May 2024, over 3 million DAUs play on-chain games, indicating GameFi's vibrant activity despite contrary sentiments.

This distinct disconnect between U and S underscores the fact that the majority of value accrual in the entire cryptocurrency industry is driven by speculation rather than usage. GameFi is a clear example of this, with one of the most vibrant communities and userbase it falls flat in terms of value accrual.

6. Source: Footprint Analytics

Cardano

The Cardano L1 is another prime example of S being the primary driver of value in the cryptocurrency market. According to DappRadar, Cardano currently only has 57 active dApps on the chain, in addition to being notorious for its slow development and lack of achievement concerning its goals and expectations. Despite this, Cardano is the 11th largest cryptocurrency by market capitalization, largely due to the fact that many users expect Cardano to someday deliver on its promises and suddenly become the most used chain not just in crypto but in Web2 and the world overall.

This cult-like belief in ultimate success and adoption can only be stated to be another form of speculation, indicating that the S driver is so strong it allows for a cryptocurrency to have held the position of a Top 10 cryptocurrency by market capitalization for over 7 years (until last month). Admittedly, it is not as though Cardano has had no progress whatsoever in the past few years, although the network’s achievements and usage are nowhere near as great as expected from a Top 10 cryptocurrency.

Conclusion

In examining the dynamics of value creation within the cryptocurrency market, it has become evident that speculation (S) predominantly drives the market rather than actual usage (U) of the protocols and projects. This trend mirrors the speculative nature sometimes (but rarely) seen in the traditional stock markets but it is much more pronounced in cryptocurrencies.

The analysis of various crypto narratives, including AI, RWA, memes, GameFi, and Cardano, consistently highlights the disparity between the userbase and the speculative valuation. For instance, AI and RWA tokens have shown significant price increases despite minimal actual usage, driven by external factors like news of advancements in Web2 or endorsements from influential figures such as BlackRock’s Larry Finch. Similarly, meme coins exhibit extreme speculative behavior with little to no utility, while GameFi, despite its substantial user engagement, has lagged in value appreciation.

In conclusion, while actual usage contributes to the fundamental value of cryptocurrencies, the overwhelming driver of value in the current market is speculation. This speculative nature leads to high volatility and disconnects between a project's real-world application and its market valuation.

Get Expert Help With Your Token Economy

If this article raised questions about your own token design, Simplicity Group's tokenomics consultancy is built to answer them. We work with early-stage and scaling Web3 projects to design token economies that align incentives, sustain liquidity, and survive the long term.